LIFE AFTER THE MILITARY: 7 SECRETS TO NOT GO BROKE & KEEP $ IN YOUR POCKET

COMMENT

SHARE

Introduction

You’ve been counting down the days to get to this point and you’re finally a civilian. But in the next breath after your sigh of relief that your time is up, there’s panic: how do you handle your finances in your life after the military now that the military isn’t handling everything for you? Say what you want about military service (and there’s no doubt it’s filled with its own bureaucracies), but they made getting paid and budgeting easy. You got BAH. You got deployment pay. Maybe you even got some extra cash when you got married. You had life insurance and health insurance baked in. If you were planning to stay in for your 20, that was your entire retirement plan. But now that it’s all gone, how are you supposed to sort it all out on your own? Read on to learn more about how to get your financial house in order before you leave active duty. More like this:Military Pay 2021: In-Depth Guide & Expert Tips

7 Secrets to Not Go Broke After ETSing

1. Build Your Buffer: GI Benefits & Terminal Leave

Gi Benefits

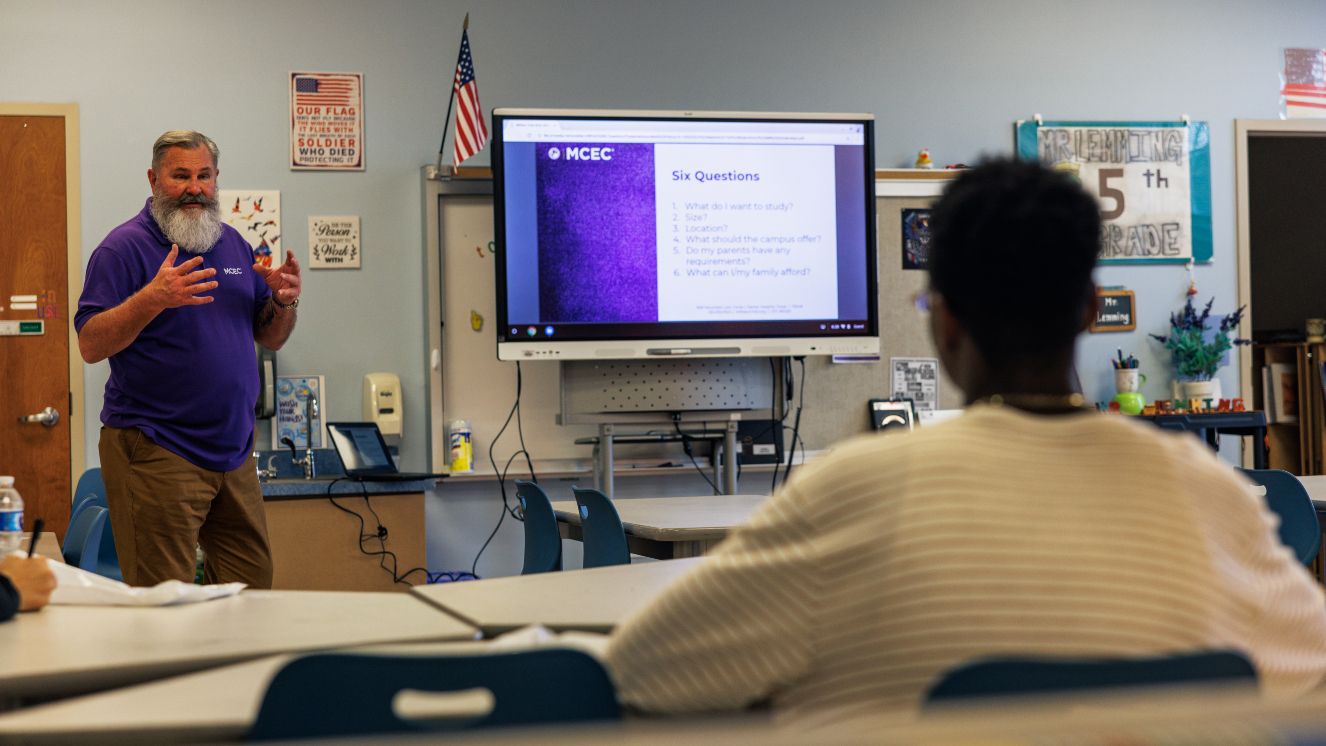

One of the best things to leave the military with are GI benefits. Using them might be one of your biggest reasons for getting out of the military. They help you get that education you might have put off for military service. Furthermore, college or graduate school or other trainings are a great buffer between active duty and the real world. You can find your footing and transition more easily into the civilian side when you know which GI bill benefits you have. Of course, don’t use them just for the sake of using them! You might know what you want to do after the military and if education is involved, now is a good time to use those benefits. It’s also really hard to go back to school after you’ve been in the civilian workforce for a while and earning money because school feels like a step back. So if you’ve racked them up, do your research to figure out how to use them and where you’ll get the most bang for your buck. Suggested Read:Which Online Colleges for Veterans are Really the Best This Year?

Terminal Leave

Another buffer builder is terminal leave. If you have a few months of terminal leave built up, this is the best way to transition out without anxiety about your finances. Whether you’re pursuing GI bill-supported studies or getting a job, your main source of income stops at your ETS date. If you have a job lined up for the day after you begin your terminal leave, you’ll get two incomes at once! If you don’t already have a job lined up, check out our blog What Really are the Best Jobs for Veterans…and How Do You Get Them?

2. Create an Emergency Savings Plan

It’s not as easy as waiting for the detailer to call and tell you what your next job is and where you’ll be doing it. Now that your career is entirely in your hands, don’t count on the next position being an instant one. Things fall through. Your job hunt might take longer than expected. The best thing you can do is safeguard yourself against it by having an emergency savings plan with a few months of expenses. And since you’re rolling in the dough from your military paycheck (okay, we jest... ) set some aside to help give you a cushion. You’ll also be much less tempted to take that crappy job offer when you’ve got a few months set aside. (And you can also make your life easier by starting the job hunt a few months before you process out.) In short, your emergency plan should cover all the things the government will no longer pay for: your medical insurance, state and federal taxes taken out of your paycheck, housing, and life insurance. More of your income can be taxable when you leave the service than you expected, so don’t let your future finances surprise you! There are several sources out there that help guide you through making an emergency savings plan. From Nerd Wallet to Forbes, to Dave Ramsey

3. Revisit Your Housing Plans

You know what’s funny about figuring out where to live after military service? It’s much harder than anyone tells you. Sure, we all complained about the limited choices the detailer would deliver (which usually boiled down to “bad” and “worse”) but suddenly the world is your oyster…and that means you have no clue where to live. The perfect blend for veterans is a place with a decent housing market, good school systems if you have young kids, a low cost of living, and job opportunities. By choosing a place to live where you can stretch your income (or keep things inexpensive while you’re back in school) you’ll make your life a lot easier. And beyond the financial expense of it, there’s the general lifestyle and veteran friendliness of places to consider, too. Here’s a list that we put together of where to live after you’re done with service to consider if you need a jumping-off point. If you already know where you want to live check out our sister site AHRN for rental and off-base housing listings. And when you're ready to finally dive in, only consider the best home loan lenders for you. Churchill Mortgage, for example, is in a unique place to help all your housing plans become a reality. At Churchill Mortgage, they do things differently than your average mortgage company. Churchill understands everyone’s goals (both financially and in life) are different, which means your home loan needs will be different too. Their goal is to make sure you are set up for financial success and help give you the smartest path for homeownership, regardless of your starting point. Put simply: Churchill is a lender with a different mission: Doing what's right for you.

4. Figure Out Health Insurance

Welcome to the ninth portal of hell that is civilian healthcare insurance shopping. Tricare has its fair share of problems, but at least you just automatically got it. That’s something you might not appreciate until you lock down private coverage. Best case scenario? You get a great new job and your employer plugs you and your whole family into a stellar plan and network. But you know better than to plan for the best case because #militarylife. If you retire after 20, you can get Tricare so long as you were active duty. If you have conditions related to your service, the VA should cover them. Most people automatically turn to the Continued Health Care Benefit Program

5. Meet with a Financial Advisor

Now that Uncle Sam isn’t taking care of all the details, you don’t want to end up facing a massive tax bill. The best way to protect yourself from that is to talk to a pro. This one catches a lot of people processing out by surprise. Here’s why:

- Deployment pay isn’t taxed when you’re in a combat zone

- Lots of states do not tax income belonging to military servicemembers

- BAH is tax exempt

Even if you score a great job with the same gross income, you can take home less pay. Educate yourself so that your budget lines up with reality.

6. Set Up a Retirement Plan

Twenty years might have sounded easy when you first enlisted or got your commission, but if you didn’t make it to your end of service with that nice military retirement in your back pocket, you’re not alone. (Let’s face it: there are a lot of reasons why 20 years in service feels a lot longer than you expected.) When you leave the service, you need to save for your own retirement. And, sorry to add salt to the wound, but if your entire retirement plan was “retire at 20” and you didn’t do any saving while active duty? You have a lot of catching up to do! Open up an individual account either Roth or traditional to get things started. If you have a new employer, talk to them about contributing to their 401(k) or 403(b) plan. And don’t forget about anything you might have from active duty, either. Unless you’ve already logged over a decade of service or so, you’re likely part of the “Blended Retirement System.” Those are some fancy words for a traditional military pension with a defined contribution plan. It’s the TSP. If you have money there, either keep them in place or roll them into an IRA, 402(b), or 401(k). More like this:5 Ways to Build Wealth With Military Pension & VA Disability

7. Get Life Insurance

Life insurance for military veterans should be one of your top priorities on the civilian to do list. You might assume that your days of high-risk are over now that deployments are off the table, but don’t leave your family exposed. Get a private life insurance policy if you’re not going to continue with the military one. Your life insurance coverage will be lost after 120 days post-separation. You can then convert your SGLI to a Veteran’s policy after a physical in most cases. Or you can move it into a whole life policy, which is often a lot more expensive.

Conclusion

Yes, it’s overwhelming to get out. Yes, it might also be the right decision for you. But you’ve got to recalibrate your entire budget and financial plan and it means taking a lot more responsibility than you did when you were active duty. It becomes easy to overlook all the ways the military made it easier for you to keep everything automatic and in one place. Celebrate #Adulting. My virtual assistant sends me digital stickers every time I do something necessary but boring like getting my oil changed or scheduling an annual wellness visit. It made me think: we all deserve stickers. And why shouldn’t financial adulting get us the biggest stickers of all? Because there’s nothing fun about debating between term and whole life insurance. But it does remind you of so many military missions: we’re all in this together. And even if you feel like a hot mess financially, you’ve got a chance to get things back on track and to claim your own financial future. Is your brain on overdrive after all of this information? Enjoy one of our trending articles Sylvester Stallone vs Arnold Schwarzenegger: Who Was Best? as you decompress.

Join the Conversation

BY LAURA BRIGGS

Laura Briggs is a Contributing Writer at VeteranLife.com.

Laura Briggs is a Contributing Writer at VeteranLife.com.