2025 VETERANS PENSION RATES: EVERYTHING YOU NEED TO KNOW

COMMENT

SHARE

Eligible Veterans can receive pension benefits; however, they’re affected by a number of factors, including their income and current net worth. The 2025 Veterans pension rates are out after Congress has determined rates for the year. In addition to eligibility variables, you’ll need to understand how your benefits are calculated as the VA will look at Housebound or Aid and Attendance benefits and has its own way of determining income. Here’s everything you need to know about your compensation in 2025.

2025 VA Veterans Pension Rates Overview

Veteran pension rates are determined by looking at the Maximum Annual Pension Rate (MAPR) and subtracting your yearly income.

How much you receive also changes depending on the number of dependents you have, and whether or not you qualify for Housebound or Aid and Attendance benefits.

To estimate your Veteran pension benefits, you’ll subtract your yearly income from your MAPR. This will provide you with your yearly amount and to determine how much you receive each month, simply divide this figure by twelve.

Below is how to calculate both of these variables:

Calculating Income

Income under the VA will include the following:

- The amount you earn

- Social Security benefits

- Investment and retirement payments

- The income your dependents receive

You can reduce your income by subtracting qualifying expenses. This includes things like non-reimbursable medical expenses but they will vary.

Calculating Your Maximum Annual Pension Rate (MAPR)

The MAPR cost-of-living increase of 2.5% went into effect on December 1, 2024, for the 2025 Veteran pension benefits.

There is also a Standard Medicare deduction that can apply, which is based on your individual income; however, this is calculated by the Social Security Administration (SSA).

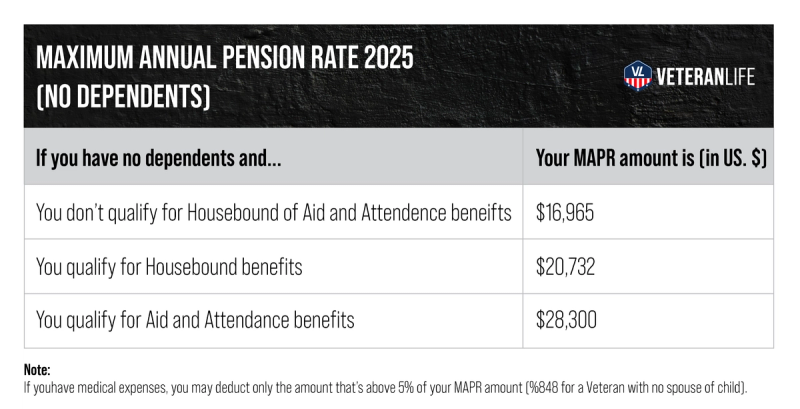

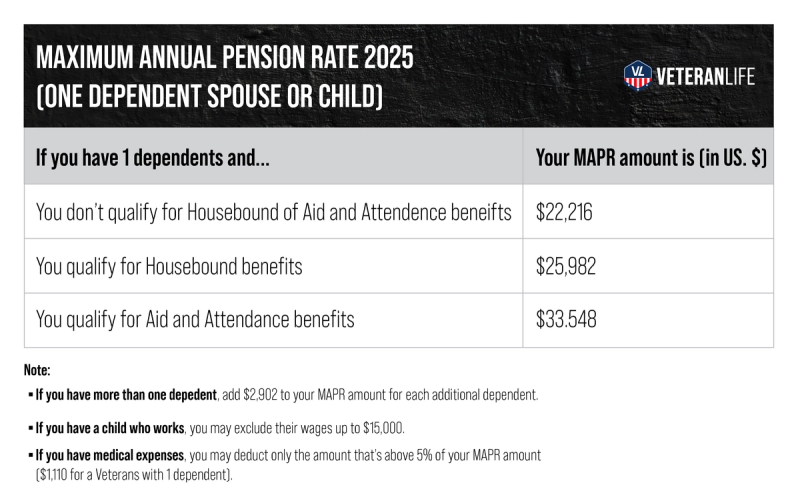

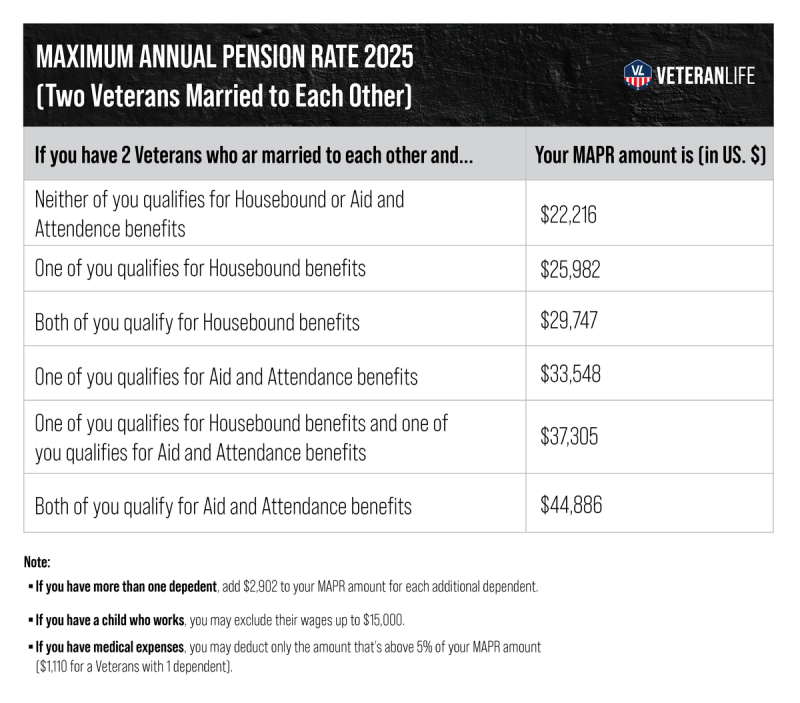

MAPR is the maximum amount of pension you can receive, which varies depending on a few different factors. These figures are adjusted for the cost of living each year. Here’s how they shape up for 2025:

MAPR 2025 (No Dependents)

MAPR 2025 (One Dependent Spouse or Child)

MAPR 2025 (Two Veterans Married to Each Other One Dependent Spouse or Child)

VA 2025 Net Worth Limit for Pension Benefits

From December 1, 2024, to November 30, 2025, the Veterans pensions benefit asset limit is $159,240.

Remember, if your child has a higher net worth than your limit, they are not considered to be a dependent.

Defining Assets

The VA looks at the total fair market value for all of the real and personal property you own after subtracting your mortgages. This includes the following:

- Real estate (land and buildings)

- Investments ( stocks, bonds, etc.)

- Antique furniture

- Boats

Your vehicle, your primary residence, and basic home items, such as a refrigerator or other items you wouldn’t take if you moved, are not counted by the VA.

How the VA Defines Your Annual Income

The VA defines your annual income by adding up the amount of money you receive in a year from employment, retirement, or annuity payments. This includes the following forms of payment:

- Salary/hourly pay

- Tips

- Commissions

- Bonuses

- Overtime

Applicable deductible expenses can be subtracted from your annual income for VA purposes and your net worth—educational expenses and medical expenses you don’t receive reimbursement for.

VA Pension Benefits Eligibility Criteria 2025

To qualify for your pension benefits, you’ll need to be discharged from the military with anything other than dishonorable conditions, and meet the following criteria:

- 90 days or more of active duty service, serving at least one of them during a period of wartime.

- Alternatively, Veterans who are permanently and totally disabled or 65 or older also qualify.

Remember, you also have to meet the income and net worth requirements to receive your VA pension.

VA Pension Benefit Penalty Period Details 2025

VA pension claims involve reviewing the terms and conditions of assets you may have transferred before filing for up to three years.

Keep in mind that if you transfer them under fair market value during this period and they elevate your net worth above your limits, you won’t receive benefits for up to five years. This is known as a penalty period.

A penalty period is how long you are no longer eligible for the VA pension and also comes with a rate of $2,795 for Veterans.

To learn more about the Veterans Pension program, you can also check out our benefits guide or through the VA at your regional office or by calling 1-800-827-1000.

Read more:

Join the Conversation

BY BUDDY BLOUIN

Buddy Blouin is a Contributing Writer at VeteranLife.com

Buddy Blouin is a Contributing Writer at VeteranLife.com