VETERAN BENEFITS ARE CHANGING IN 2025: WHAT'S NEW WILL SHOCK YOU

COMMENT

SHARE

Table of Contents

Understanding Veterans’ benefits is an evolving task, and we here at VeteranLife are here to help. Our guide to VA benefits features a ton of resources aimed at helping the Veteran community find the help and compensation they rightfully deserve. From applying for benefits to finding the right forms and much more, it doesn’t matter if you need education, home loans, disability, or healthcare, we’ve got you covered below. Including several updates involving upcoming VA benefits changes in 2026, the latest disability rates, what to expect to happen with your benefits, and the benefits cutbacks that have and are going to occur in 2025.

2025 VA Benefits Updates: Key Changes and Impacts

Veterans’ compensation benefits are projected to increase in 2026. Currently, they are projected to increase by 2.6% across all VA entitlement benefits. These changes go into effect on December 1, 2025, and will be reflected in compensation checks for the January 1, 2025 payments.

- If you are a retired Veteran, you’ll receive $26 more per $1,000 for your retirement pension.

- Those who receive compensation through the Career Status Bonus (CSB/Redux retirement plan) receive an additional $16 per $1,000.

- VA benefits for disabled Veterans are also rising in 2025 by 2.6%, depending on your rating and the number of dependents will determine how big of an increase you will receive. Veterans with a 100% disability rating with no dependents will receive around $99.61 more per month.

- VA dependency and indemnity compensation (VA DIC) benefits are also increasing for surviving spouses to $1,696.05 for basic compensation as there is no more “widows tax.”

Below are additional changes you should be aware of that are currently in progress.

- The VA opened six new health care clinics around the nation. Two clinics are located in Virginia, along with new clinics in New York, Kansas, Montana, and Colorado.

- After the VA abruptly ended the VASP (Veterans Assistance Servicing Purchase) program in May. In July, the VA Home Loan Reform Act was signed by the President. It is designed to help prevent foreclosures and homelessness among the Veteran population, and provides help to those behind in payments on VA backed home loans.

- Remote employees were brought back to work to allow them to work better as a team to serve Veterans.

- VA.gov & other VA mobile apps will require a Login.gov or ID.me account for sign-in. The MyHealthyVet option was removed March 5, 2025, and the DS Logon will be removed September 30, 2025.

- Members will still be able to access My Healthy Vet health portal, but you will need to sign in with a login.me or login.gov account.

- Rates for DEA for 2025-2026 were released in August raising rates by 2.47%.

- Full time enrollment is $1574.00

- ¾ time enrollment is $1244.00

- ½ time enrollment is $912.00

While the 2025 VA benefits increase is important, it’s worth noting that there are also notable cutbacks to pay attention to.

Benefit Cutbacks That Have/Are Occurring in 2025

So far in 2025, there have been several changes implemented throughout the VA, affecting care for Veterans. Some changes are already in the process of being implemented while other changes are still in progress. Here are the most important changes to know about in 2025.

- The VA expanded the MISSION Act allowing Veterans to receive care from non-VA providers at the department's expense. In May, the VA stopped requiring secondary approval in hopes of making the program easier for Veterans to use. Currently, Congress is working to expand private health care through the ACCESS Act. In July, it passed out of committee and may be considered by the House after their summer break.

- The VA is currently looking to reverse the Biden-era expansion to abortion care. The new policy would only allow abortions if the life of the mother would be endangered if the fetus was carried to term.

- In January, all DEI programs within the VA ended, cutting $14 million in spending.

- In March, the VA announced that it would be phasing out treatment for gender dysphoria. The VA no longer offers cross-sex hormone therapy to Veterans who have a current diagnosis or history of, or exhibit symptoms consistent with, gender dysphoria. They are currently receiving care or are receiving care upon their separation from the military and are eligible for VA Health Care. Money saved from this change is being funneled to help paralyzed Veterans.

Another change that isn’t directly tied to VA benefits but does affect Veterans receiving care are the federal workforce cuts and their impact on VA services.

- The VA released an internal memo earlier this year stating that up to 80,000 employees would be laid off.

- Cuts were hurting care so in June the VA removed over 100 roles from the hiring freeze leading to thousands of job openings within the VA. The VA is working to “right size the force” and will continue to find ways to both cut workers while providing quality care for Veterans.

- The Veterans Crisis Line relies on support staff and the hiring freeze and workforce reduction was taking a toll. In June, many roles within the Veterans Crisis Line were removed from the hiring freeze to ensure Veterans received quality care in their time of need.

Accessing VA Assistance for Veterans Benefits

Navigating the Veterans Affairs benefits available to those who have served and their families can be a lengthy process, to say the least. Seeking help can help you get the most out of your benefits and avoid misunderstandings down the road.

However, who helps you is an important decision that will affect your journey. Not only do you want someone knowledgeable to help you get the most out of your VA Veterans’ benefits, but you’ll also want to avoid scams.

The unfortunate truth is that many people and organizations take advantage of benefits for Veterans as an opportunity to steal, commit fraud, or take personal information all under the guise of help.

Making matters worse, scams are on the rise. In 2024, Veterans and military retirees reported $419 million in losses due to scams.

Many organizations are warning about these increases that are proving popular because of the increase in benefits due to legislation, such as the PACT Act.

The good news is that you can still receive help for navigating Veterans’ benefits.

Here are reputable organizations that are known for helping Veterans find the right benefits, understand their options, and maximize them all with trusted advice every step of the way:

VA

If you need help with VA benefits for Veterans, what better place to start than with the source?

You can apply for benefits in many different ways, more on that later; however, working with an Accredited Representative from the VA is one of the best ways to find assistance for understanding your options, how to file, submit claims, etc.

If you wish to find a VA Accredited Representative, you can locate one and manage your relationship with them by logging into your eBenefits account.

Additionally, dealing with the VA means a lot of paperwork, and this can be an overwhelming experience.

Throughout our guide, we provide you with many valuable tools, resources, and references to help you navigate Veteran benefits; however, if you need clarification on the forms, we can help.

You can find a VA form online simply by clicking the link and searching by the form’s name, number, or even using keywords.

Disabled American Veterans (DAV)

Working with the VA may not be for everyone. Furthermore, you may rely on the VA for a resource, such as determining your Veterans benefits eligibility. Or, you may feel more comfortable filing a claim with a third party.

The experts at Disabled American Veterans are a great resource that offers trusted help to help you navigate benefits and avoid scams in the process.

Available throughout the country, DAV offers Vets help with navigating benefits as well as filing claims and appeals. Best of all, the services are free.

DAV can also help you understand one of the more complex issues some Veterans face: navigating disability benefits.

The experts are available to help determine how to file for service-connected disability compensation and how the VA calculates disability ratings for Veterans.

To receive assistance for your VA benefits, you’ll need to contact DAV and get connected to the closest office near your ZIP code. Find your local DAV office by clicking the link.

American Legion

Since 1919, the American Legion has been committed to helping the military community, including Veterans, for their various needs.

Offering Accredited Service Officers, the American Legion provides free help to Vets to assist with a wide range of needs involving benefits.

The main focus of these Service Officers revolves around helping with disability benefits; however, they are trained to help with providing resources and info on topics that range from education to death benefits and much more.

You can find a Service Officer near you for your specific needs in just a few clicks.

Veterans of Foreign Wars (VFW)

The VFW understands that while there are plenty of Veterans benefits available, understanding them and receiving them at their fullest is not an easy process.

In an effort to help Vets get the most out of their benefits, with a strong focus on healthcare, the VFW also offers Accredited Service Officers to lend a hand to the Veteran community.

To find receive help from a VFW Service Officer, you’ll want to follow these steps:

- Click the link to find the many ways the VFW helps you get the most out of your Veteran benefits.

- From there, you’ll want to click on either “VA Claims & Separation Benefits” or “Mental Wellness” to navigate to the next page. Even if you need educational benefits, if you need assistance with Veterans benefits, click on one of those options.

- Finally, you’ll notice that on the right side of either webpage, there are options to “Find a Service Officer” or “Find a State Contact” which will help you find the assistance you need.

Military Officers Association of America (MOAA)

If you are a member of MOAA, experts are available to help you understand your pay and benefits as a Veteran.

However, receiving one-on-one counseling from a team of highly trained professionals is only available to those with PREMIUM and LIFE membership levels.

Wounded Warrior Project (WWP)

The WWP team is another trusted source for Vets offering free assistance for navigating benefits.

WWP’s team of Accredited National Service Officers is a large part of the process as anyone registering with the organization will provide staff when connecting with the WWP Resource Center.

As needs change over time, the WWP Resource Center remains a valuable part of your team. They can connect you with the right path and resources necessary to get the most out of your benefits.

Steps to Apply for 2025 Veterans Benefits

To apply for Veterans benefits is a simple idea too often convoluted by the process itself. You simply need to make contact with the VA and provide the necessary information to prove that you’re eligible.

However, this process does take on many different shapes and forms depending on the benefits you are applying for. Here’s what to consider when applying for Veterans benefits broken down by the type of benefits you’re seeking:

Applying for VA Healthcare

When applying for Veterans’ benefits regarding healthcare, you have a few options:

- Call the VA healthcare number at 877-222-8387 to speak with a representative any time between 8:00 am and 8:00 pm ET Monday through Friday.

- You can also fill out and mail VA Form 10-10EZ to Health Eligibility Center PO Box 5207 Janesville, WI 53547-5207. This is the same form you use for VA dental benefits.

- If you’d like to bring your VA Form 10-10EZ in person, simply find your nearest VA medical center or clinic to deliver it in hand.

- As mentioned above, you can have a professional handle it. Just make sure they are an expert from a trusted resource to avoid problems, including scams.

Applying to the Veteran Readiness and Employment (VR&E) Program

If you need to file for the VR&E program, online is the recommended option. However, Veterans can complete a VA Form 28-1900 and mail it or go in person to turn it in at their local regional office.

Applying for Disabled Veterans Benefits

Veterans in need of disability benefits can file online to apply. Mailing a completed VA Form 21-526EZ to the U.S. Department of Veterans Affairs Claims Intake Center PO Box 4444 Janesville, WI 53547-4444.Alternatively, you can fax the form to (844) 531-7818 if you’re stateside or (248) 524-4260 if you’re outside of the United States.

Of course, if you want to turn in the form in person, you can take a trip to your local regional office as well. For a more in-depth look at how to apply for VA disability, click the link to read our guide.

How to Apply for VA Long-Term Benefits

If you are eligible for benefits, you’ll need to contact your VA social worker to discuss your options. Be sure to be a part of the VA healthcare program before doing so. You can also contact the VA healthcare hotline for more information.

Applying for VA Dependency and Indemnity Compensation (VA DIC) Benefits

Families who need to apply for VA DIC benefits have many different forms depending on the benefits they need to receive. Here’s how to apply and the forms you’ll need:

- If you are applying for DIC, Death Pension, and/or Accrued Benefits by a Surviving Spouse or Child, submit a completed VA Form 21P-534a with the help of your Military Casualty Assistance Officer, who will mail it to the appropriate regional VA office.

- Families who need to apply for DIC, Death Pension, and/or Accrued Benefits can fill out a VA Form 21P-534EZ.

- Surviving parents can apply by filling out an Application for Dependency and Indemnity Compensation by Parent(s), also known as VA Form 21P-535.

If you need to apply for VA DIC benefits, you can either mail your form to your state’s Pension Management Center (PMC), visit a regional office, or work with a trusted representative.

Applying for Veterans Pension and Survivors Benefits

To apply for Veterans pension or survivor benefits, you can do so online for the easiest method. Mailing VA Form 21-534EZ to your state’s PMC is another viable option.

Alternatively, survivors have three different methods for applying for benefits:

- Send your VA Form 21P-527EZ by mail to the PMC.

- Bring the form to apply in person at your local VA regional office.

- Help from a trained professional.

Submitting a VA Intent to File Form

By law, when you are applying for VA Survivors Pension benefits, DIC, or accrued benefits, you must submit evidence to the VA proving you are eligible. Because of this, submitting an Intent to File form beforehand can be beneficial.

By submitting a VA Intent to File, you gain time for gathering the evidence you’ll need giving you an earlier effective date. You may even get retroactive payments by submitting the form.

If you wish to notify the VA, call them at 800-827-1000 or complete VA Form 21-0966. Mail it to the Department of Veterans Affairs Claims Intake Center PO Box 4444 Janesville, WI 53547-4444.

Alternatively, you can bring your VA Form 21-0966 to your VA regional office or have an Accredited Representative assist you.

Applying for a Discharge Upgrade

There are certain situations in which you may need to upgrade your discharge status in order to receive Veterans’ benefits. This is possible on a case-by-case basis but you need to apply.

The way it works is Veterans will need to answer confidential questions and provide the information to the VA who will begin the process to determine whether or not an upgrade is appropriate.

If you are a Veteran who was discharged due to mental health conditions, military sexual trauma (MST), or your sexual orientation due to the Don’t Ask, Don’t Tell policy, it’s likely you’ll receive an upgrade.

Even if you have a less-than-honorable discharge, the review can determine that it was honorable for VA purposes and provide you with some benefits as a result.

Keep in mind that you can ask for a VA Character of Discharge review while also looking to apply for a discharge upgrade from the DoD or the Coast Guard.

You can also apply for an upgrade if you don’t succeed the first time, though following a slightly different method.

Those with multiple discharges can use an honorable one to help plead their case for VA benefits if their other discharge requires an upgrade, though service-connected disability compensation is only available for disabilities that occurred during the period of honorable service.

For Veterans who never received a DD214 but separated with an honorable discharge, you can apply and explain that you never received your paperwork.

To apply for a discharge upgrade, simply click the link. You’ll find plenty of instructions pertaining to your specific situation. Once you have the right process to follow, click “Get Started” and begin filling out your information.

Applying for the VA Aid and Attendance Benefits and Housebound Allowance

If you qualify for VA Aid and Attendance or Housebound benefits, fill out the VA Form 21-2680 and mail it to your state’s PMC or go to your VA regional office in person. Your doctor can help you fill out the examination section.

In addition to the VA Form 21-2680, you can provide the details about your daily activities, how you get around, a doctor’s report showing your need for aid or housebound care, information about how your disability affects activities of daily living (ADLs), etc.

If you live in a nursing home, your application must also include the VA Form 21-0779.

Applying for Education Benefits for Veterans

The best way to apply for Veterans’ education benefits is simply following the steps online.

However, if you wish to proceed by mail, you can request an application from 8:00 a.m. until 7:00 p.m. ET Monday through Friday, by calling the Education Call Center at 888-442-4551, or TTY: 711 if you are hard of hearing.

Once you receive the application, fill it out and send it through the mail to the VA regional claims processing office near the school you’re attending.

Alternatively, you can go to a VA regional office near you in person and have an employee help you fill out the form. You can also work with the certifying official at your school, typically found in your school’s Registrar or Financial Aid office.

Finally, like many Veteran benefits, you can always use the help of a professional when applying.

How to Apply for the Fry Scholarship

If you qualify for the Fry Scholarship, applying is simple:

- Find the school you wish to attend. You can use the GI Bill Comparison Tool for help. Be sure to contact an official at your school to double-check that your program is approved for Veteran benefits.

- Apply for your benefits online or send a completed VA Form 22-5490 to the VA regional office near the school you wish to attend. If you aren’t an adult, make sure a parent or guardian signs the application.

- For those who are applying but have already begun their education, you’ll need to have a certifying school official or employer fill out VA Form 22-1999 found in the VA’s Enrollment Manager system.

- Select the Fry Scholarship as in most situations, you can’t qualify for both the scholarship and VA DEA benefits, though some exceptions apply, as discussed below.

Note: When you choose between the Fry Scholarship and DEA benefits you can’t change your mind later. Be sure to conduct due diligence based on your needs before making a decision.

How to Apply to the Post-Vietnam Era Veterans’ Educational Assistance Program (VEAP)

Those qualifying for VEAP benefits can call the Education Call Center, or visit their closest VA regional office for assistance when applying.

To submit your application, you can fill out and submit VA Form 22-1990 through the mail, in person, or online, as you would for the GI Bill.

Additional items may be needed on a case-by-case basis. Be sure to verify your enrollment with the VA. After a review, the VA will let you know what else is needed to apply for benefits.

How to Apply to the National Call to Service Program

If you qualify for educational benefits through the National Call to Service Program, you’ll need to apply through the mail.

Fill out VA Form 22-1990n and mail it to the VA regional processing office near the school you’ve chosen, or if you have yet to choose your school, you’ll want to mail it to the office near your home. Addresses are on the form.

Applying for Home Loans

If you are a Veteran or a service member, you can apply for a VA home loan Certificate of Eligibility (COE) by using eBenefits; however, you must also apply through your lender for a home loan COE.

To apply by mail, fill out VA Form 26-1880 and mail it to your regional loan center, which can be found on the last page of the form. Your real estate agent can help you take advantage of the Veteran benefit.

Survivors who are eligible can also mail their application by filling out a completed VA Form 26-1817 to their regional loan center or by calling 1-877-827-3702.

Again, leaning on your real estate agent here will help you along the way.

Applying for Veteran Life Insurance Benefits

How you apply for Veteran life insurance benefits is going to depend on the type of policy you’re looking to enroll in. Some don’t require enrollment while others do, and each has its own process. Here’s how it all works:

Servicemembers' Group Life Insurance (SGLI)

You don’t have to apply for SGLI coverage as it’s automatic; however, if you want to designate beneficiaries or adjust your coverage, you’ll need to either use the SGLI Online Enrollment System (SOES) or form SGLV 8286.

You can determine which method is appropriate for your coverage by visiting this website.

Veterans' Group Life Insurance (VGLI)

If you need to apply for VGLI coverage, visit your eBenefits account or download and fill out the SGLV 8714 form and mail it to the following:

OSGLIPO Box 41618

Philadelphia, PA 19176-9913

Family Servicemembers' Group Life Insurance (FSGLI)

Similar to SGLI coverage, if you want to alter your FSGLI coverage, you either need to use a form (SGLV 8286A) or the SOES. You can determine your best option by visiting this website.

Servicemembers' Group Life Insurance Traumatic Injury Protection Program (TSGLI)

While TSGLI is automatic coverage for service members covered by SGLI, if you need to file a claim, be sure to download, fill out, and submit an SGLV 8600 form.

Veterans Affairs Life Insurance (VALife)

If you are a Veteran who has a disability connected to serving in the U.S. military, you may qualify for coverage through VALife. When you apply for VALife online, you’ll be able to see if you qualify.

Note: you’ll need to pay your first premium payment at the time of applying for coverage.

Veterans' Mortgage Life Insurance (VMLI)

Applying for VMLI coverage means submitting a completed VA Form 29-8636 to your Specially Adapted Housing Agent. You must provide the necessary details of your current mortgage when applying. Your agent can help.

How to File a Life Insurance Claim

As you can see, there are many different forms of VA life insurance coverage available. Because of this, each policy is going to have its own method of filing for death benefits, forms you’ll need to fill out, places to contact, etc.

Feels like a lot? Not to worry, you don’t have to feel overwhelmed, as the VA has a dedicated page on filing a life insurance claim that provides you with everything you’ll need all in one place, including:

- The webpage shows you which filing method to use for each policy and how to send your information to the VA.

- All of the forms you’ll need are available with just a few clicks of a button.

- Contact information, such as phone numbers, addresses, offices, etc., are all laid out for your claim.

- Additional resources, including videos, to help along the way.

COLA Act

One of the hottest topics in the community is the threat of Veteran benefits cut in a way that would hinder resources for Vets.

The COLA Act of 2023 helps ensure that Veteran benefits keep up with the rising cost of living.

Determined by SSA, the legislation provided an increase of 3.2%, affecting clothing allowances, VA DIC, disability, and more.

Typically, the next COLA is announced at the beginning of each Fiscal Year, or around October 1, and goes into effect January 1 of the next year.

Veterans Benefits Administration (VBA)

The VBA is one of three agencies within the VA tasked with leading programs involving Veteran benefits that provide financial compensation to Vets, dependents, and survivors, including the following:

- Compensation Services, such as disability benefits

- Educational programs

- Life Insurance

- Loan Guaranty Services for the VA Guaranteed Home Loan Program

- Outreach, Transition, and Economic Development, which forms partnerships both in and out of the VA to help Vets transition into civilian life.

- Pension and Fiduciary Services, including pensions and Dependency and Indemnity Compensation (DIC) benefits.

- The Office of Administrative Review carries out the guidelines put forth in the Veteran Appeals Improvement and Modernization Act of 2017.

- The Office of Field Operations, which helps organize the operations of VA district offices and 56 regional offices within the United States, Puerto Rico, and the Philippines, among other responsibilities.

- Veteran Readiness & Employment (VR&E) services.

You can contact VBA at 1-800-827-1000 (TTY: 7-1-1) or by locating the closest office to you.

Veterans Health Administration (VHA)

The VHA represents one of the largest healthcare systems in the world and is dedicated to helping 9 million Veterans with their needs.

Featuring more than 1,300 healthcare facilities, the VHA provides primary care, specialized care, and various related services to those who have served and require healthcare.

You can contact the VHA by calling 1-877-222-8387, by finding an office near you, or at 810 Vermont Ave. NW, Washington, DC 20420.

National Cemetery Administration (NCA)

The NCA oversees the VA’s national cemeteries, Soldiers' lots, and monument sites throughout the United States and Puerto Rico.

Over 4 million Americans are laid to rest in these cemeteries. Veteran cemeteries are found stateside, throughout U.S. territories, Guam, Saipan, and tribal trust lands.

There are many different VA Veterans’ burial benefits that include certain allowances and the allocation of commemorative items for those receiving a funeral/burial.

The NCA ensures that these benefits are properly distributed to those who qualify while also maintaining the resting places and memorials of the Veterans who have passed.

You can contact local VA national cemetery offices online or by calling 800-827-1000.Additionally, you can reach the National Cemetery Scheduling Office at 800-535-1117 to plan the burial of a loved one at any open VA national cemetery.

PACT Act Benefits for Veterans: 2025 Overview

The PACT Act was a bill signed into law that increased compensation benefits for Veterans in August 2022.Overall, PACT Act benefits for Veterans focus on helping those exposed to toxins when serving understand and receive the care and extra benefits they deserve.

Millions of Veterans gain better access to benefits thanks to the law and no longer have to prove their service-related connection to 23 different illnesses in which care is necessary.

To learn more about how Vets are covered, check out our guide to the PACT Act for a more in-depth look.

Related read: The Ongoing Fight for PACT Act Benefits

Veterans Social Security Benefits: 2025 Guidelines

Many within the military community wonder about “extra” Social Security benefits for Veterans and how it affects other forms of compensation.

The Social Security benefit for Veterans doesn’t affect your military pension and vice versa. You'll receive your full Social Security benefit based on your earnings.

However, Veterans and Social Security benefits may be affected when it comes to compensation for survivors.

Your survivors' benefits could affect optional Department of Defense Survivors Benefit Plan payouts, and it’s important to speak with DoD or your Military Retirement Advisor for details.

If you have health coverage from the VA, TRICARE, or Civilian Health and Medical Program (CHAMPVA), your benefits may change with your Medicare eligibility, but again, because this varies from person to person, be sure to contact the VA, DoD, or your Military Health Advisor.

Vets who served from 1940 to 1956, including service academy attendance, without paying Social Security taxes, special earnings credits may qualify for Social Security and Medicare benefits or boost their Social Security payout.

These credits are added when you apply for Social Security benefits and are earnings of $160 per month if you meet at least one of the following:

- You received an honorable discharge after 90+ days of service but suffered a disability or injury while in the line of duty leading to your release from the military.

- Are still an active duty military member.

- You are a survivor applying for benefits because a Veteran passed away while on active duty.

- Are unable to receive credit for your special earnings if you already receive a federal benefit based on the same years of military service. However, there is an exception for those who were on active duty after 1956. Special earnings for 1951 through 1956 are available based on your service in that timeframe, even if you receive military retirement benefits.

Social Security Benefits for Disabled Veterans

There are two programs offering Social Security benefits for disabled Veterans. Here’s how they break down:

- Social Security Disability Insurance (SSDI) - a program that is available to workers and qualifying family members who have worked the required hours to qualify for benefits. This varies by age.

- Supplemental Security Income (SSI) - a program available to those 65 years of age and older and for anyone who is blind or has a disability. However, SSI is only available to those who are below the required financial limits. You can check your SSI eligibility online.

Keep in mind that while both the VA and SSA provide disability benefits for Veterans, the qualifying criteria, processes, and overall programs are different for each:

Criteria for Disability VA SSDI

Injury or illness caused by serving in the U.S. military Yes No

Impairment must stop the ability for substantial gainful employment when applying No Yes

The disability must last 12 months, be expected to, or result in death No Yes

Age/education/work histories affect eligibility No Yes

Benefit amount and eligibility are not affected by SSDI or VA disability benefits

Partial payments depending on the severity of your disability No Yes

All-or-nothing benefit payment No Yes

Social Security Benefits for Veterans With PTSD

If you have PTSD, you are covered by the Americans with Disabilities Act of 1990 (ADA). You also qualify for disability benefits.

The VA rates PTSD at 0%, 10%, 30%, 50%, 70%, or 100%. You don't need to have each symptom to qualify for your rating level. Always be truthful during your examination.

Below is a breakdown of each disability rating for PTSD:

Government and Third-Party Support for Veterans

Utilizing the VA for your benefits is a must but there are several other government agencies and resources that can help Veterans receive assistance for their many needs.

One of the most important things to remember is that if you have Veteran benefits, you may still be eligible for other programs and they may not affect what you receive from the VA.

Each program and state has different criteria, but while not everyone will qualify, many Vets in need still can. Here are some important resources you won’t want to forget about while getting the most out of your benefits:

Supplemental Nutrition Assistance Program (SNAP)

SNAP benefits help families put food on their tables by issuing an electronic benefit transfer (EBT) card that works similarly to a debit card and can be used to purchase nutritious meals.

You can use SNAP at a number of stores and even at farmers’ markets where available. The key here is eligibility, which will come down to your income level. Combat pay is not counted as your income.

You can apply for SNAP benefits online by clicking the link and choosing the state you live in. To learn more about Veteran food stamps, be sure to click the link and check out our guide.

Related read: Can Veterans Get Food Stamps? Not as Many That Should

The Special Supplemental Nutrition Program for Women, Infants and Children (WIC)

WIC provides funding to women, infants, and children under the age of five who are at risk of lacking access to nutritional food.

To be eligible for WIC, you’re going to need to meet the criteria in your state and it’s worth noting that Veterans may qualify for additional benefits and services.

Contact your state or local WIC agency or go online to your state's website if you would like to set up an appointment. You can also set up an appointment by calling your WIC State office’s toll-free number.

School Breakfast and National School Lunch Programs (SFSP)

SFSP helps kids get healthy breakfast and/or lunch at a variety of local hubs once school takes a break during the summer months. You can find sites near you by using the online Summer Meal Site Finder tool, texting “Summer Meals” to 914-342-7744, or calling 1-866-348-6479.

Food Distribution Program on Indian Reservations (FDPIR)

Another great resource for Veterans is the FDPIR which delivers USDA Foods to those on Indian reservations and living in Native American households in certain areas.

To determine whether or not you meet the income requirements or to see if your area is participating in the program, use the online tool. States that are dark gray are not a part of FDPIR.

United States Department of Agriculture (USDA)

Beyond the initiatives by the USDA to provide Vets and their families with nutritious meals, other programs are aiming to help the military community.

Keeping Americans fed takes a lot of work and it's a role the USDA knows all too well.

To keep the supply chain running means keeping trained, capable manpower available and the USDA helps Vets find careers working within the agricultural industry.

The Military Veterans Agricultural Liaison (MVAL) bolsters rural communities by helping Vets jumpstart agricultural ventures in a number of ways.

This includes finding employment for Vets and their spouses to gain employment in the USDA, paid apprenticeship opportunities, hands-on training experiences, financial assistance programs, and non-profit internships.

There are a lot of different options that vary from region to region. To learn more about the opportunities that best suit you and your family, contact the USDA by sending an email to veterans@usda.gov.

United States Department of Housing and Urban Development (HUD)

Veteran homeless programs are available through the HUD-Veterans Affairs Supportive Housing (HUD-VASH) initiative which is a collaboration between HUD and the VA.HUD-VASH provides Vets with both HUD’s Housing Choice Voucher (HCV) rental assistance for homeless Vets and the VA’s case management and clinical services.

Some of the facilities offering HUD-VASH are VA healthcare centers; however, community-based outreach clinics (CBOCs), are also available in certain areas to lend a hand.

Related read: Homeless Veterans on the Rise in 2024, VA Ramps Up Housing Efforts

United States Department of Health and Human Services (HHS)

The HHS aims to improve the health and welfare of all Americans through effective health and human services while advancing medical, public health, and social sciences.

When it comes to the military community, these initiatives become abundantly clear with many different programs and resources available.

HHS assists in employment, health, mental health, substance abuse, and child and family services for Veterans. Through its various divisions, HHS offers tailored resources and programs to support military families.

Simply put, there is a lot going on. HHS has assistance helping Vets find jobs, receive healthcare, deal with substance abuse and mental health issues, and dedicated resources for children and families.

If you want to learn more about what HHS has to offer Veterans and how to take advantage of these benefits, be sure to check out their resource guide on how the HHS supports military families.

2025 VA Disability Benefits for Veterans

Certain disabilities with service-connected conditions can provide Veterans with a variety of benefits, depending on the nature of the disability and its severity. There are resources, compensation, and processes Veterans should be aware of.

Benefits for Disabled Veterans

Just because you have a disability or condition, doesn’t mean you’re eligible for benefits; however, if you have one of the following, the VA may provide benefits if you are found to be eligible based on one of the following:

- Anxiety and depression

- Breathing issues due to a current lung condition or lung disease

- Cancers along with other conditions caused by contacting toxic chemicals or other dangers

- Chronic back pain causing a back disability that has been currently diagnosed

- Hearing loss deemed severe

- Loss of range of motion

- Mental/physical health conditions due to military sexual trauma (MST)

- PTSD

- Scar tissue

- Traumatic brain injury (TBI)

- Ulcers

Military Base Toxic Exposure Veterans Disability Benefits

The specific benefits available to Vets for toxic exposure continue to grow over the years. Depending on the chemical hazards or other hazardous materials you may have come in contact with while serving, compensation for your conditions/illnesses is available due to the VA classifying them as presumptive conditions:

- Agent Orange

- Asbestos

- Birth Defects

- Burn Pits/Specific Environmental Hazards

- Contact With Mustard Gas or Lewisite

- Contaminated Drinking Water at Camp Lejeune

- Exposure to Radiation

- Gulf War Illnesses in Afghanistan and/or Southwest Asia

- Project 112 or Project SHAD

To learn more about the specifics of each benefit and the eligibility for them, you can visit the VA online.

Related read: New Study Ties Toxic Burn Pit Exposure to Neurological Disorders

Eligibility for VA Disability Benefits

Thanks to the PACT Act, VA disability benefits have expanded over recent years to help more Vets gain access to the healthcare and resources they deserve. In order to qualify for VA disability compensation, you must meet the following criteria:

- Your mind or body is affected by a current condition.

- You served either on active duty, active duty for training, or inactive duty training in the U.S. military.

- While there are exceptions and ways to apply for an upgrade, generally, you must also separate from your service with an honorable discharge.

Additionally, anyone who meets these requirements must also have one of the following apply to receive VA disability benefits:

- While serving, you became sick or injured and it’s linked to a service-related condition.

- You already had an illness/injury before enlisting but serving made the condition worse.

- You discover a disability related to your active-duty service after you’ve finished service.

Remember, there are also presumptive conditions that you are automatically assumed to have been affected by simply by serving in certain capacities. This includes the following categories:

- Have a chronic illness that appears after being discharged within a year.

- You develop an illness because of toxic chemicals or other hazardous materials.

- You contract an illness during your time as a POW.

Understanding the VA Disability Percentage Table

The amount you receive for your disability compensation will vary based on how disabled you are. Rates range between 0% and 100% in 10% increments. Additionally, the following factors will affect how much compensation you receive:

- If you are a Veteran who has very severe disabilities or loss of limb(s).

- If you have a spouse, child(ren), or parents who are qualified as your dependent(s).

- You are eligible and have a seriously disabled spouse.

- Cost-of-living adjustments (COLA) also affect compensation year-to-year as the VA adjusts for inflation and will affect your benefits.

To gain a greater understanding of the VA disability compensation rates, click the link to read our annual guide.

PTSD Veterans Benefits

Not all of the health factors Veterans have to face are inherently physical. Over the last few decades, an expanded focus on mental health resources has been a priority for the VA, including benefits and assistance for PTSD.

Veterans may be eligible for PTSD benefits, which can provide tax-free monthly compensation, connections to mental health professionals, and other forms of assistance.

For immediate help, Veterans in crisis, or if you are concerned about someone who may be, the 988 Veterans Crisis Line is available or you can text 838255 or call TTY at 800-799-4889.

Your local emergency room, VA medical center, and 911 are also available, even if you don’t have a discharge status or healthcare from the VA.

Determining Eligibility for PTSD VA Benefits

To be eligible for PTSD benefits from the VA, you’re going to have to have suffered a stressor while serving in the military and have a doctor diagnose you with PTSD.

Keep in mind that in order to receive some benefits, such as VA healthcare, you’re going to need to apply for a disability rating.

Traumatic events must also meet the right criteria for the VA to consider them. The following apply:

- Serious injury

- Personal trauma

- Sexual trauma or violation

- You were threatened by someone/something with death, injury, or sexual assault.

If you meet these eligibility criteria, you’ll need to file for VA disability benefits. Throughout the process, your PTSD will be the focus of qualifying for compensation.

You’ll need to submit additional forms to the VA depending on your PTSD, including "A Statement in Support of Claim for Service Connection for PTSD" (VA Form 21-0781) or "A Statement in Support of Claim for Service Connection for PTSD Secondary to Personal Assault" (VA Form 21-0781a).

Time is not a factor and if you haven’t filed for PTSD Veteran benefits but may qualify, even if it has been decades, Vets are encouraged to reach out.

Finding treatment is a separate matter as the VA will not provide you with treatment unless otherwise noted while determining your eligibility.

If you wish to receive PTSD health services, you’ll need to apply for VA healthcare first.Once you apply, speak to your VA primary care provider about your concerns. Your primary care provider will help you gain access to resources and can offer treatment for your symptoms.

Related read: Why Veterans are Turning to Psychedelic Treatments for PTSD and Trauma

What Benefit Services Are Available for Veterans With PTSD?

The benefits for Veterans with PTSD are extensive with the VA offering just under 200 treatment programs throughout the United States. Here’s what they offer Vets:

- Mental health assessments/testing to diagnose your PTSD in a 1-to-1 setting.

- Medicine for PTSD that is scientifically proven to work as a treatment.

- 1-to-1 psychotherapy (talk therapy) is available as treatment, including Cognitive Processing Therapy (CPT).

- 1-to-1 therapy for families. Group therapy is also available for those with special needs, including anger management and combat support.

- Specialized group therapy for Veterans based on particular combat zones or traumas is also available at 300 community VA centers.

Additionally, some facilities also offer Veterans additional benefits, which include:

- Access to PTSD specialists for regular outpatient care is available at VA medical centers.

- Special residential (live-in) or inpatient care programs—found in each region of the U.S.—help Veterans with severe PTSD symptoms who have trouble doing normal daily activities (like going to work).

- Providers offer added PTSD care in some of our large community-based outpatient clinics.

- Telemental healthcare is available for those who can’t reach a VA medical center or clinic due to proximity.

In addition to the benefits and resources above, the VA also offers a National Center for PTSD. This facility is a leading authority on PTSD treatment as well as research and education to better treat symptoms in the future.

To learn more about accessing the facility, be sure to check out our guide on how to use the National Center for PTSD.

For additional benefits and resources, Veterans should be aware of and refer to the following:

- PTSD benefits are available for homeless Vets, who can contact the National Call Center for Homeless Veterans at 877-424-3838 to learn more.

- The VA’s “Understanding PTSD and PTSD Treatment” booklet is a valuable resource for anyone looking to learn more about the disorder and their options.

- VA expert-recommended self-help resources are available online.

- You can also reach out to a VA PTSD Coach online for help.

Title 38 Veterans Benefits Claim

Suing the military in any capacity is a difficult, often impossible task, however, there are options for those who have suffered due to healthcare at the VA.

Title 38 of the United States Code provides the framework for Veterans to file an 1151 claim under certain conditions when receiving VA healthcare or while participating in a VA employment program.

Veterans’ benefits are available for those who have either suffered a new disability or had an existing disability get worse due to at least one of the following:

- Carelessness or negligence from the VA.

- You received healthcare treatment, including surgery, or a health exam from the VA.

- You took part in a VA vocational rehabilitation course or VA compensated work therapy (CWT) program.

To be successful in your claim, you’ll need to show proof that your disability occurred because of one of the items listed above.

If you successfully file a claim, you won’t have a change in your disability rating; however, your monthly compensation payment will change.

You can file your claim online now, over the phone, in person, or by mail.

U.S. Army Biological and Chemical Testing Healthcare

Veterans who volunteered for testing involving chemical and biological programs can receive healthcare through the U.S. Army. This healthcare is directed at as many as 60,000 Veterans who volunteered between 1942 and 1975.

If you have an injury/illness that was caused by participating in these programs, you have options. To learn more, contact the Army at 800-984-8523.

Veterans Benefits Banking Program: 2025 Features

Veterans, beneficiaries, and caregivers all have access to a benefit for banking that can help them better handle their finances in an evolving world.

Since December 20, 2019, the VBBP has been a collaboration between the VA and the Association of Military Banks of America (AMBA) available to those who qualify at participating banks and credit unions.

Qualified users can open accounts. They receive not only options for banking but also enhanced financial resources focused on education to improve the knowledge of Vets and promote greater literacy and freedom as a result.

You can receive Veterans benefits using direct deposit. Overall, the VBBP can help protect against Veteran fraud.

Additionally, some products and services available through the VBBP are exclusive. If you aren’t enrolled, you won’t have access to them.

If you’re interested in setting up your direct deposit, the VA can help. Simply call them at 1-800-827-1000, or create an account to enroll online.

Requesting a Veterans Benefits Letter in 2025

Veterans benefit letters (VA award letters) detail your service dates, disability rating, and your status of discharge. These letters are necessary for Vets to receive certain benefits.

In order to receive your VA Benefits Summary Letter, you’re going to need to have an account and log into https://www.va.gov/. Be sure to have the latest version of Adobe Acrobat Reader and you can download VA letters online.

2025 State-Specific Veterans Benefits Overview

While there are many federal options and benefits for Veterans from organizations, each state and U.S. territory offers its form of benefits and perks.

State benefits for Veterans may include tax exemptions, financial assistance, free recreational licenses, license plates, and more.

It’s important to check into state Veterans benefits available near you to better understand what your options are.

For example, Chapter 115 Veterans’ benefits in Massachusetts cover a wide range of expenses for families who qualify. Some states offer cash benefits simply for serving.

From state benefits for disabled Veterans to saving on education and much more, you’ll want to get in touch with your state’s Veterans Commission.

Each state government has its own Veterans Commission that aims to help Vets by advocating for their needs as well as providing help and resources for getting the most out of their benefits.

VA Veterans Burial Benefits: 2025 Details

When Veterans are laid to rest, a proper send-off is necessary and to help lift some of the burdens from grieving families, Veterans' burial benefits are available to handle the cost of the funeral, provide mementos, and more.

While the information below is a small summary of the Veterans’ death benefits available for service and non-service-related burials, there is a lot more to cover that will likely pertain to you or a loved one’s celebration of life.

For a more in-depth look at VA burial benefits, be sure to check out our guide. There you’ll find the Veterans' spouse burial benefits, eligibility requirements, the forms you need, how to apply, tips, and more.

Related read: How to Use VA Bereavement Counseling if You’ve Lost a Loved One

Service-Related Burial Benefits for Veterans

If a Veteran is receiving a service-related burial, the VA provides benefits for burials, plots, or internments at a flat rate allowance.

Veterans’ funeral benefits for those being buried in a VA national cemetery may also include transport costs.

The most eligible surviving spouses receive automatic payment of the death benefits for Veterans’ and while these funds can help with funeral costs, they may not cover everything.

Non-Service-Related Burial Benefits for Veterans

For Veterans who have passed for non-service-related reasons, the VA provides burial benefits at a different rate. Veterans’ death benefits will still help with burial and funeral expenses and plot-internment.

Spouse and Dependent Benefits for Veterans in 2025

VA benefits for the spouses of Veterans as well as dependents encompass a wide range of resources. Both dependent children and parents can also benefit from these resources.

You’ll note that the benefits for spouses and dependents of Veterans include healthcare, education, housing, pension, career counseling, job training, burial benefits, grief counseling, and more.

To fully understand VA family member benefits, you can explore their webpage along with the highlighted benefits we discuss throughout this guide.

Deceased Veterans Benefits for Grandchildren

If you are a grandchild of a Veteran who has passed away, you may be eligible for benefits; however, you’ll need to meet certain criteria in order to qualify.

Everyone is going to have a different scenario; however, many Veterans’ dependents' benefits involving grandchildren are going to fall into one of the following categories:

- Education - If you are going to college or receiving some sort of training/education after high school, scholarships and financial aid may be available. Your best bet is to work with your regional VA office and the institution you are attending to understand your options better. State resources dealing with Veterans may also be able to help.

- Life Insurance - Many grandchildren may be beneficiaries under a VA life insurance policy. You can learn more about how to file in the section near the top of the page to receive your death benefit.

- Pensions and Survivor Benefits - An especially tricky area to navigate, benefits for grandchildren of Veterans may be available through pension funds and survivor benefits. The VBA is likely the best place to reach out to for assistance.

Regardless of the benefits grandchildren may or may not receive eligibility is going to heavily depend on whether or not they are a dependent of their qualifying Veteran grandparent in order to receive compensation.

Family structures look differently from home to home but you will need to prove that any grandchildren receiving benefits are a dependent to qualify.

One notable exception listed above is life insurance death benefits, which only require the person receiving the benefits to be the beneficiary as declared by the Veteran within their policy.

2025 VA Education Benefits for Veterans

Educational benefits for Veterans can help you and your family pay for the rising costs of going to school.

While most understand this includes college tuition, Veteran education benefits include a lot more, including:

- Covering other educational and training programs approved by the VA.

- Assistance finding the right school or program for your needs.

- Career counseling resources are also available.

- Some travel and living expenses may also be covered, depending on personal factors.

- Alternative program options may also be available for Veterans who do not qualify for Post-9/11 GI Bill benefits.

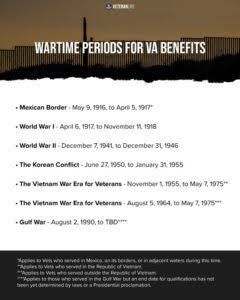

The benefits you have access to will depend on eligibility factors similar to other forms of VA compensation; however, when you served is going to be a notably important factor here.

Below is a breakdown of the many different types of benefits Veterans receive to help them with their educational pursuits:

Veterans Education Benefits for Spouses and Dependents

There are education benefits for surviving spouses and dependents; however, you’ll need to make decisions as to what is best for your needs and which benefits you qualify for.

Known as the Survivors’ and Dependents’ Education Assistance (DEA), those who qualify can also receive the Fry Scholarship, but remember, you can’t have both at the same time. You also can’t switch once you pick.

There is an exception to qualify and use both if you are a child who suffered the loss of a service member who passed away before August 1, 2011, in the line of duty. In this case, you can use both, though not at the same time, for a total of 81 months of training/education.

On top of working with the VA or an Accredited Representative, your school or program is going to have resources available to help you weigh your options, understand how they help you, and make an informed decision.

Below, explore our guide on the many different Veteran education benefits for spouses and dependents to help you get started:

Chapter 35 Veterans Benefits

Also known as Veterans DEA benefits, Chapter 35 helps provide education to children and surviving spouses of Vets and service members who either have a disability, have died, or are either captured or missing.

To qualify, one of the following must be true and apply to the Veteran or service member:

- They are permanently, totally disabled due to service.

- Died in the line of duty.

- They died due to a service-connected disability.

- They went missing in action or were captured in the line of duty over 90 days by hostile forces.

- Were subject to forcible detention or interned by a foreign entity for over 90 days while in the line of duty.

- They are hospitalized or receiving outpatient treatment due to a service-connected permanent, total disability that will likely result in being discharged from the military.

In addition to the qualifications by Veterans and service members, if you are a surviving spouse or dependent, you must also meet one of the following criteria to qualify:

- You are at least 18 years old.

- Alternatively, you can be under 18 years old, but you must have finished either high school or secondary education.

Children who qualify for DEA benefits do not have their eligibility influenced by their marital status.

Those who qualify for monthly payments through Chapter 35 benefits can use them for college, including graduate degrees.

These benefits are also available for apprenticeships, certificate courses in career training, on-the-job training, and career/educational counseling.

For those enrolling in non-college degree programs, be sure to verify your enrollment monthly in order to receive payments. You can do this online, through the mail, or over the phone. Click the link to get started.

If you are enrolled in a college degree program, you won’t have to verify your benefits monthly.

To determine how much you’ll receive and which school accepts your benefits, you can find DEA payment rates online and the GI Bill Comparison Tool to find approved schools and training centers.

Finally, if you qualify for both DEA and DIC benefits, you must be a child of a qualifying Veteran or service member to receive both. You also can’t be over 18 years of age to receive DIC when using DEA benefits. Spouses, however, can use both DIC and DEA payments.

DEA Benefit Time Limits

If you are eligible for DEA benefits, there are time limits on when you can use the compensation for your education. There are exceptions but you must meet certain criteria to qualify. Here’s how it works:

- If you are using DEA benefits to cover the cost of education for school or training that began before August 1, 2018, your benefits may be available for as much as 45 months; however, if you began school or training on or after August 1, 2018, you only have a maximum of 36 months.

- You are a spouse or child using DEA benefits, you don’t have age or time limits so long as the Veteran or service member who qualified for them did so on or after August 1, 2023, you turned 18 years old on or after the same date, or you finished your high school or secondary education on or after this date as well.

- If you are a spouse or child who either had a Veteran/service member qualify for DEA benefits before August 1, 2023, you turned 18 years old before the same date or finished high school before the same date. Under these criteria, you can access your benefits at the age of 18 for 8 years in most cases. You also can’t use these benefits while on active duty in the military or after the military if you receive a dishonorable discharge, however, you receive an extension for availability, typically until you’re 31.

- Spouses can use DEA benefits within 10 years and they become available based on the VA’s determination or when the Veteran or service member dies. You can receive benefits for 20 years if the service member dies on active duty.

- Suppose you’re a spouse and qualify for benefits from a permanently and totally disabled Veteran, who has an effective date within 3 years after being discharged from active duty. In that case, you have 20 years of access. Some exceptions apply and these benefits can’t be used while in the military or after a separation from service due to a dishonorable discharge.

Fry Scholarship

Both children and spouses of Veterans may qualify for the Fry Scholarship, an initiative named after Marine Gunnery Sergeant John David Fry. It provides money to help pay for tuition, housing, and books and supplies for 36 months.

The Fry Scholarship is available if your parent or spouse died in the line of duty on or after September 11, 2001, or if they died because of a service-connected disability in the Selected Reserve.

Your marital status doesn’t affect your eligibility if you are a child who qualifies; however, if you’re a spouse, you can’t remarry and qualify.

The scholarship is available until you’re 33 years old if you turned 18 or graduated high school before January 1, 2013.

Everyone who becomes eligible for the Fry Scholarship by turning 18 or graduating high school after January 1, 2013, can receive this scholarship any time after meeting the age requirement or graduating, whichever is first.

No age requirements exist for those who qualify due to a parent with a service-connected disability while not on active duty in the Selected Reserve.

If you qualify for the Fry Scholarship, DEA benefits, and DIC payments, note that you can’t use them all at once.

You can only use the Fry Scholarship while not using the DEA program and if you have DIC, you have to forfeit it when you start using the scholarship.

Keep in mind that “State Active Duty” that can apply to the Army and Air National Guards isn’t included in “not on active duty” when it comes to qualifying for the Fry Scholarship.

Related read:7 of the Best Veteran & Military Spouse Tech Scholarships (& Free Training Programs, too!)

Disabled Veterans College Benefits for Dependents

If you have a disability and need special restorative training or assistance with college for dependents, you have options. The VA education benefits are available for those with and without disabilities along with qualifying dependents.

Furthermore, those with a physical or mental disability who need training so that they can pursue an education or are interested in special vocational training may receive additional benefits, however, medical and psychiatric care are not included.

Veterans GI Bill Benefits

Since 1944, Veterans' GI benefits have been available to help pay for education and training across many different initiatives that have evolved over the years.

It’s important to understand the different GI Bills available as depending on when you served, among other factors, your eligibility will affect which benefits you qualify for.To learn more about these programs, check out our guides:

- The Veteran’s Complete Guide to GI Bill Benefits will help you decipher between the Post-9/11 GI Bill and the Montgomery GI Bill benefits.

- You can use your GI Bill benefits on your own education or put them towards the educational pursuits of a dependent. Learn more about using the GI Bill for dependents, including how to decide what is right for you and how to transfer your benefits.

Edith Nourse Rogers STEM Scholarship

If you’re a Veteran and eligible for the Post-9/11 GI Bill or have dependents using the Fry Scholarship for extra benefits, you can qualify for the Edith Nourse Rogers STEM Scholarship if you are working on getting a certification for teaching.

Keep in mind these benefits are not available to dependents and you can’t use them to pursue graduate degree programs.

Just because you qualify doesn’t mean you’ll receive the scholarship. If you want to improve your chances, priority is given to Vets and Fry Scholars who meet the following guidelines:

- Have eligibility for the maximum 100% Post-9/11 GI Bill benefit.

- You have more credit hours than others who apply.

The following programs are eligible for the Edith Nourse Rogers STEM Scholarship:

- Agriculture/natural resources sciences

- Biological/biomedical sciences

- Computer and information science and support services

- Engineering/engineering technologies/engineering-related fields

- Healthcare or related fields

- Mathematics/statistics

- Medical residency as an undergrad

- Physical science

- Science technologies/technicians

You can receive either 9 months or $30,000 worth of benefits to train if you meet at least one of the following criteria:

- You are either enrolled in a program for an undergraduate degree in STEM or a dual-degree program that qualifies.

- Are enrolled in an approved clinical training program in the healthcare industry after already earning either a graduate or post-secondary degree.

- You have a post-secondary degree in an approved STEM field and are working on getting a teaching certification.

To better understand the full requirements for eligibility, it’s important to consider the following scenarios.

Anyone who is already pursuing an undergraduate STEM degree or qualifying dual-degree program must also meet all of these requirements:

- Enrollment must be in an approved STEM program that is going to take a minimum of 120 standard semester credit hours or 180 quarter credit hours to complete, and you already have at least half of them completed.

- You receive Post-9/11 GI Bill or Fry Scholarship benefits but only have 6 months or fewer left.

Anyone who qualifies for benefits and is working on a clinical training program for healthcare must also:

- Have a degree in STEM that qualifies.

- Receive admission or be enrolled in a covered clinical training program for healthcare professionals.

- You have 6 months or fewer left for your Post-9/11 GI Bill or Fry Scholarship benefits.

Finally, if you are pursuing a teaching certification, you must:

- Have a qualifying post-secondary degree in a STEM field.

- Be either accepted or enrolled in a teaching certification program with 6 months or fewer left of your Post-9/11 GI Bill or Fry Scholarship benefits.

To apply for the STEM scholarship, simply fill out an online application, which takes about 15 minutes to complete. Scholarships are awarded each month and it takes as much as 30 days to determine who receives funding.

You may receive a letter if more information is needed, however, if you are approved for benefits, you receive a Certificate of Eligibility (COE) through the mail, known as a decision letter.

You will need to bring your COE to the VA certifying official at whichever school you are attending. If you are not approved, you’ll receive a denial letter through the mail.

If you are receiving a monthly housing allowance, this is sent directly to you.

Keep in mind that you need to verify your enrollment monthly to receive payments. If you are part of a Veteran work-study program, you can use the benefit; however, you can’t use the scholarship with the Yellow Ribbon Program.

Related read:7 of the Best Veteran & Military Spouse Tech Scholarships

Yellow Ribbon Program

The Yellow Ribbon Program is a great option for paying the cost of tuition for certain schools not eligible for compensation through the Post-9/11 GI Bill.

This includes private, graduate, and out-of-state schools. To learn more, check out our guide on Yellow Ribbon Schools.

Veterans Chapter 33 Benefits

Also known as the Montgomery GI Bill, if you aren’t eligible for the Post-9/11 GI Bill, Chapter 33 benefits may be able to help you cover the cost of your education.

There are benefits available based on active duty and compensation for those who are serving in the Reserves.

Furthermore, Chapter 32 benefits are available if you have served during a period of national service, and the post-Vietnam Era Veterans’ Educational Assistance Program (VEAP) is a government assistance program for those who served for the first time between January 1, 1977, and June 30, 1985, while contributing to a VEAP account.

You can learn more about the Montgomery GI Bill through our guide by clicking the link. Below, we’ll break down the National Call to Service Program and VEAP:

National Call to Service Program

As an alternative benefit to the Montgomery GI Bill, those eligible for the National Call to Service program can pay for their education.

You can receive either $5,000 cash, repayment of your qualifying student loan up to $18,000, educational benefits equal to a monthly 3-year MGIB-AD rate for 12 months, or education benefits equal to half of the less-than-3-year monthly MGIB-AD rate for 36 months.

Here’s how you qualify:

- You must finish your initial entry training and then go on active duty for 15 months in an MOS designated by the Secretary of Defense.

- You also must serve a period of active duty for 24 months without a break in between as an active duty member of the Selected Reserve.

In addition to the qualifying criteria above, Veterans must also have had at least one of the following apply to use the program. For the rest of your obligated service, you were either:

- An active duty member of the American Armed Forces.

- A member of the Selected Reserve or Individual Ready Reserve.

- You were a member of a domestic national service program, such as AmeriCorps, jointly designed by the Secretary of Defense.

VEAP

Those who participated in VEAP during its initial run and when it was reopened between October 28, 1986, and March 31, 1987, before it was ultimately terminated, can use their assistance for education.

Before implementing the MGIB Program, some service members were a part of VEAP, in which educational assistance came from a government match of $2-to-$1 contributions.

Here’s how to know if you’re eligible for benefits as you must meet all of these criteria:

- You served between January 1, 1977, and June 30, 1985, for the first time in any branch with the exception of the U.S. Air Force.

- You contributed between $25 and $2,700 to your VEAP account before April 1, 1987.

- You completed your first period of service without receiving a dishonorable discharge.

For Airmen, things get a bit more complex. To qualify for VEAP benefits, you must meet these guidelines:

- You served in the USAF between December 1, 1980, and September 30, 1981, for the first time under one of the following specialties:

- 20723

- 20731

- 20830

- 46130

- 46230A, B, C, D, E, F, G, H, J, or Z

- 46430

- 81130

- Furthermore, you must have enlisted at specific locations to qualify. Here are the locations that grant Airmen VEAP benefit eligibility:

- Beckley, West Virginia

- Buffalo, New York

- Dallas, Texas

- Fargo, North Dakota

- Houston, Texas

- Jackson, Mississippi

- Louisville, Kentucky

- Memphis, Tennessee

- Omaha, Nebraska

- Philadelphia, Pennsylvania

- Seattle, Washington

- Sioux Falls, South Dakota

- Syracuse, New York

For Airmen still serving, you’ll need to have at least 3 months of VEAP contributions to access your benefits.

2025 Health Benefits for Veterans through VA

As one of the largest healthcare systems in the world, there are more than 9 million Veterans who receive care through VA facilities.

Veterans' health benefits are essential for helping both mental and physical ailments that may or may not be related to servicing our nation.

The health benefits you are eligible for will depend on many factors and are unique from Veteran to Veteran. Some of the factors that affect your medical benefits package include:

- Your VA priority group

- The advice of VA healthcare professionals

- The medical standards the treatment your healthcare requires

Important Information About Veterans Medical Benefits

Healthcare is complex and working with the VA is no exception. Many more resources are available, and before making any decisions regarding your health, it’s important to speak with a medical professional.

Here are a few important facts about VA healthcare you’ll want to remember when you’re seeking treatment:

- VA healthcare is considered to meet the “minimum essential health coverage” required by the Affordable Care Act (ACA).

- You can better understand how the VA uses/discloses your private medical information, how to access it, and how to opt out of sharing by contacting the VA’s Medical Records Office.

- If you’re leaving the military and need assistance, you can call the VA healthcare number (877-222-8387; TTY: 711). You can also learn more about transitioning from TRICARE to the VA online.

- Travel benefits and support for caregivers are also available.

- Foreign language and American Sign Language (ASL) services are available. Click this link to find your medical center’s website. You’ll need to contact their customer service to find a patient advocate for your VA medical center.

- There are over 1,200 locations to receive care and you can manage your VA healthcare benefits online to check the status of your claims, message your healthcare team, or refill prescriptions.

Remember, the benefits you receive with the VA are going to differ for everyone; however, there are some baseline healthcare needs you can count on being addressed.

Here’s an overview of what basic Veterans’ health benefits will cover:

Preventive Healthcare

- Gender-specific healthcare, including the unique needs of women

- Health and nutritional education programs

- Healthcare assessments

- Immunizations

- Professional counseling on genetic diseases

- Various health exams

Related read: Women Veterans Should Know About These Available Resources and Benefits

Inpatient Healthcare

- Acute care (short-term treatment for a severe illness or injury or after surgery)

- Kidney dialysis

- Medical treatments

- Prescription drugs provided by VA physicians

- Specialized care, such as surgeries, intensive care (physical and mental), etc.

- Surgeries

Suggested read: How Vets Can Mitigate the Risks of Cancer Related to Military Service

Urgent and Emergency Healthcare

- Urgent/emergency care at qualifying VA facilities

- You can also use your Veterans’ medical benefits at urgent cares within the VA’s contracted network for injuries/illnesses that aren’t life-threatening but require immediate care. So long as you’re enrolled in VA healthcare and have received care within the last 24 months from the VA, you can use these facilities.

- You can also receive emergency healthcare from hospitals, clinics, or other medical facilities outside of the VA; however, certain conditions must apply. If you need non-VA emergency care for a non-service-connected condition, you must receive care in an emergency department, notify the VA within 72 hours, and meet additional requirements. To learn more about getting non-VA emergency medical care, click the link.

Additional Healthcare

- You can receive a range of mental health services that help treat depression, military sexual trauma (MST), posttraumatic stress disorder (PTSD), and substance use.

- If you require assisted living or home healthcare needs, your benefits may help. Note that both have limits for the number of people who can enroll in these programs at once as well as criteria for income.

- Veterans can also receive refills on prescriptions and have some medications approved/written by VA doctors as needed.

- Ancillary healthcare services, such as X-rays, blood work, tests, etc., may also be covered. You can even receive therapy, rehab, and prosthetic items.

- The VA will cover some vision care, such as eye exams and preventative tests, and if you’re blind or have an impairment, even more healthcare options may be available, including glasses. To learn more about VA vision care, click the link.

- Normally, you can’t receive coverage for medicines and devices that don’t have approval from the Food and Drug Administration (FDA). If you are accepted into a clinical trial and receive approval, you may receive an exception. This is known as compassionate use or an expanded access exemption. This happens when something is new and unapproved because there aren’t similar treatments available.

Veterans Spouse Medical Benefits

While Veterans' healthcare benefits aim to help those who have served our nation, there are also many medical benefits for spouses, survivors, and dependents available.

The benefits available to families will vary depending on eligibility based on numerous factors surrounding the Vet or service member’s time in the military.

If you are a spouse, child, or parent that qualifies, here are some of the benefits from the VA you may have access to:

- Burial and memorial services

- Career and employment benefits

- Disability

- Education and training

- Healthcare

- Life insurance

- Pension benefits

- VA home loans

Throughout our guide, you’ll find help on how to apply for spousal benefits, eligibility, resources, and much more.

Veterans Assisted Living Benefits

Assisted living is an important part of care for Veterans with disabilities and/or later on in life. There are several different options available and you may have access to these benefits.

You can receive care for your medical needs and nursing services 24 hours a day, 7 days per week along with help performing ADLs.