ASSUMABLE VA LOANS: POTENTIAL SAVINGS AND RISKS FOR 2023

COMMENT

SHARE

In a real estate market where interest rates are sky-high and affordability is shrinking, there’s a little-known benefit hiding in plain sight—and it could save both buyers and sellers thousands: VA Loan Assumption.

If you're a Veteran homeowner, your assumable VA home loan might be worth more than you think—and not just because of your home’s equity. With interest rates locked in at historic lows during recent years, your VA loan could become a hot commodity to the right buyer.

But here’s the catch: choosing who assumes your loan could unlock or block your ability to use your VA benefit again. Especially if that buyer isn’t a Veteran.

Before you say “yes” to an assumption, let’s unpack how this program works, why it matters, and what the risks really are—so you don’t unintentionally hand over your VA loan... and your future eligibility.

VA Loan Assumption: Understanding the Basics

A VA loan assumption allows a buyer to take over an existing VA home loan—including the interest rate, remaining balance, and repayment term—without originating a new loan.

This valuable tool is rare in conventional mortgages but standard in VA, FHA, and USDA–backed loans.

Who Can Assume a VA Loan?

Almost anyone—Veterans, active service members, eligible spouses, and even non-veterans—can assume a VA loan, provided they satisfy the lender’s credit and income standards.

Typically, that means a credit score around 620 or higher, and a debt-to-income ratio under ~41%.

VA Loan Assumption Benefits for Veterans

For Buyers (Veterans or Non‑Veterans)

- Lower interest rate: If the existing VA loan has a below‑market rate, assuming it can mean huge savings over time.

- Lower closing costs: No new origination fee, appraisal, or new lender’s title policy—costs may be reduced to a few thousand dollars versus $6K–$9K for a new loan.

- Minimal VA funding fee: Only 0.5% at closing (vs. 1.5–3.3% on new loans), and waived for those exempt—e.g., Veterans receiving service‑connected disability compensation.

For Sellers (Veterans)

- Selling advantage: In a high‑rate market, a VA loan with low lock‑in interest becomes a powerful listing point.

- Faster process: Often quicker than originating a new mortgage, assuming minimal paperwork and cooperation from seller and servicer.

Risks of VA Loan Assumption for Veteran Sellers

VA Entitlement Tied Up

- If a non‑Veteran assumes the loan, the seller’s VA entitlement remains tied to that loan until it’s paid off or the buyer refinances—this may limit or even prevent the Veteran from using VA benefits again right away.

- If a eteran buyer assumes the loan and performs a Substitution of Entitlement, the seller's entitlement can be restored—freeing them to use VA benefits again.

Liability & Timeline

- Until you’re formally released via VA Form 26‑6381 (Release & Substitution), you remain legally responsible for the loan—even if you no longer live in the home.

- Entitlement restoration isn’t immediate—it can take a few weeks and possibly delay your next VA purchase, especially around PCS orders.

Equity / Cash Requirements

- Buyers must pay the equity difference between the sale price and loan balance—often substantial cash. A secondary loan might be needed if they don’t have enough upfront funds.

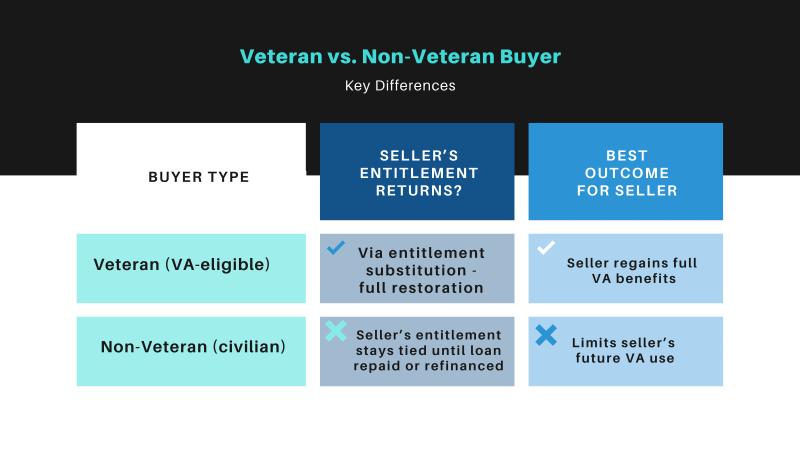

VA Loan Assumption: Veteran vs. Non-Veteran Buyer Differences

Veteran sellers aiming to preserve eligibility should prefer selling to another Veteran who can substitute entitlement.

VA Loan Assumption Process: Step-by-Step Guide

- Find a VA‑loan property where the seller’s loan is assumable (usually post‑March 1, 1988).

- Buyer submits application to the seller’s loan servicer—providing credit, income, and asset info. VA or servicer must approve.

- Verify loan terms and remaining balance. Document the seller’s equity gap (sale price minus balance).

- Buyer pays or finances the equity gap—cash or second mortgage as needed.

- At closing, the buyer pays the 0.5% assumption fee (often less or waived for disabled vets), transfers any required fees, and signs assumption paperwork.

- Seller requests release of liability and entitlement restoration, if applicable (through VA Form 26‑6381 and Substitution of Entitlement).

- Monitor servicer and VA progress—entitlement restoration can take several weeks before the seller is fully free to use VA benefits again.

Who Should Consider This?

- Veteran buyers looking to leverage below-market assumable home loans, reduce closing costs, and lock in a low rate.

- Veteran sellers wanting to market their home in a high-rate environment—especially if selling to another veteran who can substitute entitlement.

- Veteran sellers who don’t need future VA benefits, but want a smoother sale and potentially faster closing.

Next Steps for Veteran Homeowners

- Talk with a VA-savvy real estate agent and lender who understands entitlement calculations and assumption logistics.

- Confirm whether the buyer is VA-eligible—substitution matters.

- Check your remaining entitlement via VA’s eBenefits portal or Certificate of Eligibility before proceeding.

- Plan PCS or future purchases around the timeline of entitlement restoration—don’t assume it's instant.

You Hold the Keys

VA loan assumption can be a powerful shortcut to low-rate homeownership for the buyer and a strategic selling advantage—especially in today’s high-rate market.

But it comes with important consequences for Veteran sellers: if the new borrower isn't VA-eligible, your entitlement stays locked up, potentially limiting your ability to get another VA loan.

Choosing a Veteran buyer who can substitute entitlement gives you the best of both worlds: a smooth sale and future VA freedom.

Homeowners, especially Veterans, should weigh the benefits vs. risks, plan entitlement restoration carefully, and work with knowledgeable VA professionals. With the right approach, VA loan assumption can be a real win for both buyer and seller.

Managing Your VA Loan: Secure Your Financial Future

Whether you're preparing to sell or simply exploring your options, understanding the power and pitfalls of VA loan assumption is crucial.

For Veteran homeowners, this isn’t just a financial decision—it’s a strategic move that affects your entitlement, future buying power, and long-term financial security.

Sell smarter by marketing your assumable home loan as an asset.

Protect your VA eligibility by choosing a Veteran buyer who can substitute entitlement.

Maximize your savings as a buyer by assuming a low-rate VA loan and avoiding high origination fees.

Your VA loan is more than just a mortgage—it's a benefit you earned. Don’t give it away without understanding what’s at stake. Ready to take the next step? Talk to a VA-savvy lender, check your Certificate of Eligibility, and find out how to make VA assumable loans work for you.

Suggested reads:

Join the Conversation

BY NATALIE OLIVERIO

Veteran & Senior Contributor, Military News at VeteranLife

Navy Veteran

Natalie Oliverio is a Navy Veteran, journalist, and entrepreneur whose reporting brings clarity, compassion, and credibility to stories that matter most to military families. With more than 100 published articles, she has become a trusted voice on defense policy, family life, and issues shaping the...

Credentials

Expertise

Natalie Oliverio is a Navy Veteran, journalist, and entrepreneur whose reporting brings clarity, compassion, and credibility to stories that matter most to military families. With more than 100 published articles, she has become a trusted voice on defense policy, family life, and issues shaping the...